Boost Trading Results Through Proper Back Testing

This session is for traders who would like to learn a proper five-stage process of back testing a trading strategy. It will answer questions like: Why are my back testing results great but my live trading results are not? Is the system likely to work with my schedule and risk tolerance? How am I going to mechanically trade this thing?

Part 2 of this session will discuss evaluating risk vs. reward. It will answer questions like: How am I going to handle large moves, overnight gaps, and catastrophic situations? What are the steps in the trade debrief process? Finally how to create a success loop to skyrocket your results!

This session is for Trading Success Blueprint traders in Stage 2 and above to focus on.

Managing Risk When Entering, Exiting, or Rolling Positions

This session shows how to minimize the impact of market movement on P&L, how to pick a good time to enter a trade, and how to develop a process to minimize risk. One way to minimize risk is to use the Trade Execution Planner Tool provided with this session.

This session is for Trading Success Blueprint traders in Stage 2 and above to focus on.

How To Build Winning Trade Plans

Learn the #1 objective of a trading plan and ensure that plan leads to you accomplishing your established goals. Also included are the critical elements to include in your plans like risk criteria, profit target, expected profit, proper entry, and exit criteria. How to plan for a market crisis. The best way to incorporate a review and improvement procedure. Then ultimately if your goal is to trade as a business how to build a trading business plan.

This session is for Trading Success Blueprint traders in Stage 3 and above to focus on.

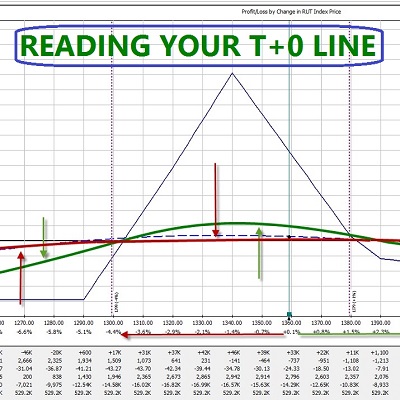

Reading Your T + O Line

Follow the T+0 line and learn what you need to know about it reacts with the Greeks, price movement, ratio spreads, upside and downside risk.

This session is for Trading Success Blueprint traders in Stage 3 and above to focus on.

Design A Trade; Trade Lab

This session describes how to define parameters for creating options trading strategies. We use M9 design as an example of designing a trade and discuss the processes with the pros and cons of different trade methods. This session is one for Trading Success Blueprint traders in Stage 4 and above to focus on.

M3LT Trade Lab

In this session, we discuss the benefits of the long-term M3 (M3 LT) and how much easier it is to trade in the current volatile markets by going further from expiration. This session is one for Trading Success Blueprint traders in Stage 4 and above to focus on.

ROCK’in 2018

This trade is just LOVED by traders for the knowledge and returns it provides. So much so that we produced this special Enriching Session that demonstrates multiple examples of the ROCK through many of the challenging price movements in 2018. This session is one for Trading Success Blueprint traders in Stage 4 and above to focus on.

Roll Baby Roll Trade Lab

The Roll Baby Roll Trade is used as an example of designing a trade and discuss the processes with the pros and cons of different trade methods. This session is one for Trading Success Blueprint traders in Stage 4 and above to focus on.

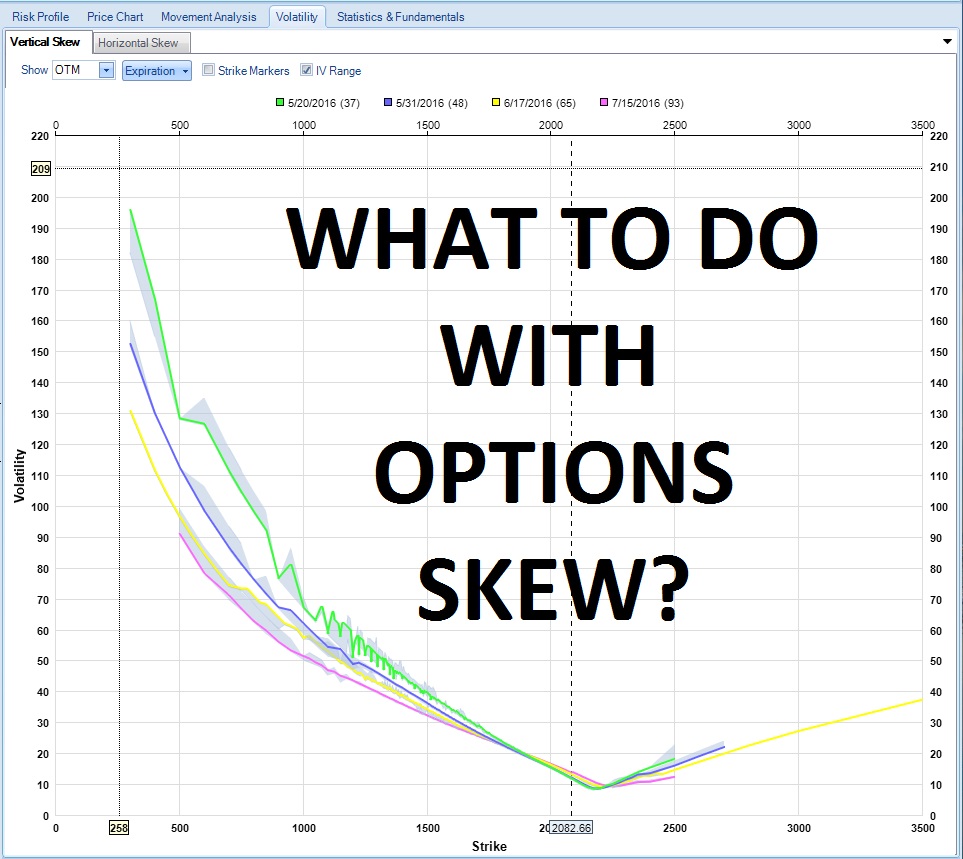

What To Do With Options Skew?

What is skew? What does it mean? How do we utilize it? These questions and many more are answered!

This session is one for Trading Success Blueprint traders in Stage 4 and above to focus on.